In the fast-paced world of finance, where decisions are often made in split seconds, having a tool that can accurately predict the financial implications of a loan is invaluable. This is where loan calculators and, more specifically, loan EMI calculators come into play. In this comprehensive guide, we will delve into the intricacies of these financial tools, exploring their functionalities, benefits, and how they can be harnessed for effective financial planning.

I. Introduction

A. Definition of Loan Calculator

Financial tools are designed to estimate the monthly payments, interest, and overall cost of a loan.

B. Importance of Loan EMI Calculator

The significance of accurately predicting Equated Monthly Installments (EMIs) for effective budgeting and financial decision-making.

C. Brief overview of the article

A sneak peek into the topics we’ll cover, ranging from the basic functionality of loan calculators to future trends in this ever-evolving landscape.

II. Understanding Loan Calculators

A. Basic Functionality

1. Principle amount

The core amount borrowed, influences the entire repayment structure.

2. Interest rate

The percentage representing the cost of borrowing, a crucial factor in calculating the total repayment.

3. Loan tenure

The duration for which the loan is taken, impacting the monthly installment amount.

B. Types of Loan Calculators

1. Simple loan calculator

A straightforward tool for basic loan estimations.

2. Advanced loan calculator

Incorporating additional variables for more accurate predictions.

3. Online loan calculator tools

Web-based calculators offer convenience and accessibility.

III. The Science Behind Loan Calculations

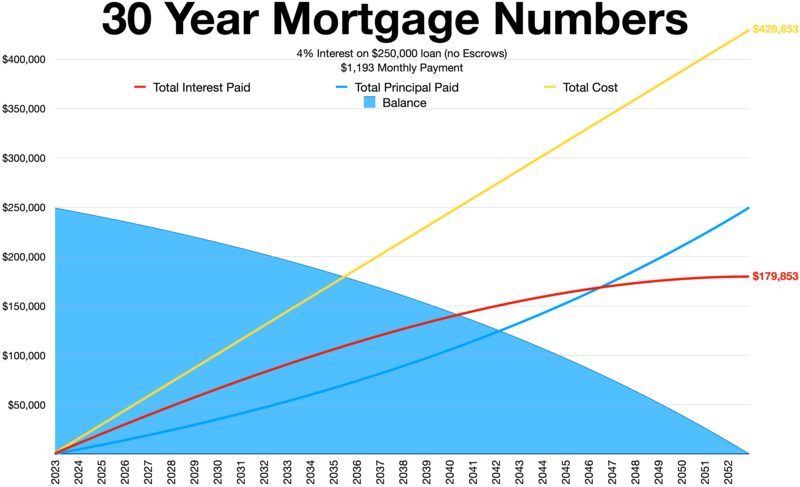

A. Compound Interest

1. Explaining compound interest in loans

Unraveling the complexities of compound interest and how it affects overall repayment.

2. Impact on total repayment

Understanding the long-term consequences of compound interest on the borrower.

B. Amortization

1. Definition and significance

Shedding light on amortization, a critical aspect of loan repayment.

2. How amortization affects monthly payments

Analyzing how the distribution of payments changes over the loan tenure.

IV. Advantages of Using Loan Calculators

A. Financial Planning

1. Budgeting with accurate estimations

How precise calculations empower individuals to plan their finances effectively.

2. Avoiding financial pitfalls

The role of loan calculators in preventing unforeseen financial challenges.

B. Comparison Shopping

1. Evaluating different loan options

Using calculators to compare and choose the most favorable loan terms.

2. Making informed decisions

Enhancing decision-making by having a clear understanding of the financial commitment.

V. Common Misconceptions About Loan Calculators

A. Accuracy Concerns

1. Addressing potential errors

Common misconceptions regarding the accuracy of loan calculations.

2. Factors influencing accuracy

Understanding the variables that may impact the precision of the results.

B. Limited Applicability

1. Dispelling myths about specific loan types

Overcoming misconceptions about the suitability of loan calculators for different types of loans.

2. Widening the scope of usability

Exploring the versatility of loan calculators beyond traditional loans.

VI. Step-by-Step Guide on Using Loan Calculators

A. Choosing the Right Calculator

Selecting the appropriate calculator based on the type of loan and individual preferences.

B. Entering Loan Details

1. Principal amount

Inputting the borrowed amount accurately for precise calculations.

2. Interest rate

Specifying the interest rate to reflect the actual cost of borrowing.

3. Loan tenure

Deciding on the duration of the loan to calculate monthly installments.

C. Analyzing the Results

1. Understanding monthly payments

Interpreting the calculated monthly installment and its impact on the budget.

2. Examining the amortization schedule

Delving into the breakdown of payments over the entire loan period.

In a world driven by financial complexities, the strategic use of loan calculators and EMI calculators emerges as a beacon of financial clarity. As we move forward in this article, we’ll explore real-life examples, delve into the intricacies of loan EMI calculators, and discuss tips for effective usage. The overarching goal is to equip you with the knowledge and tools necessary for making well-informed financial decisions.

VII. Real-life Examples of Loan Calculations

A. Home Mortgage

Entering the realm of real estate involves substantial financial commitments, and a home mortgage is a prime example. Loan calculators prove invaluable here, allowing prospective homeowners to assess the long-term impact of their borrowing decisions. Through accurate estimations of monthly payments and total repayment, individuals can navigate the complex landscape of home financing with confidence.

B. Car Loan

When considering a car purchase, understanding the financial implications is crucial. Loan calculators empower consumers to compare different loan options, helping them choose a plan aligned with their budget and preferences. From interest rates to loan tenure, these tools provide a comprehensive overview, fostering transparency in the decision-making process.

C. Personal Loan

For more flexible financial needs, such as education expenses or unforeseen medical bills, personal loans come into play. Loan calculators adapt to these scenarios, offering insights into monthly payments and helping individuals plan their budgets effectively. This versatility showcases the universal applicability of loan calculators across various financial landscapes.

VIII. Loan EMI Calculator: A Deeper Dive

A. Definition and Purpose

As we delve deeper into the specifics of EMI calculators, it’s essential to grasp their distinct role in financial planning. EMI calculators focus on the monthly installment, breaking down the repayment into manageable portions. This targeted approach allows borrowers to align their budgets with these fixed monthly commitments, ensuring financial stability throughout the loan tenure.

B. Distinctions from Standard Loan Calculators

While standard loan calculators provide a holistic view of the entire loan, EMI calculators zoom in on the monthly aspect. The differentiation lies in the emphasis on creating a feasible monthly budget, making them particularly beneficial for those with a keen eye on short-term financial planning.

C. Practical Scenarios Where EMI Calculators Shine

Consider scenarios where unexpected expenses arise, impacting your monthly budget. EMI calculators allow you to explore different repayment scenarios, helping you find an arrangement that suits your current financial situation. Whether it’s adjusting the tenure or understanding the interest implications, these calculators offer real-time insights for dynamic financial planning.

IX. Utilizing Loan EMI Calculator for Effective Financial Planning

A. Setting Realistic Budgets

1. Aligning with monthly EMI payments

Setting realistic budgets involves aligning your monthly expenses with your EMI commitments. EMI calculators serve as proactive tools, enabling you to gauge the compatibility of your budget with the proposed monthly installments. This alignment is crucial for maintaining financial equilibrium throughout the loan tenure.

2. Ensuring financial stability

Beyond aligning budgets, EMI calculators contribute to overall financial stability. By providing a clear roadmap of your monthly obligations, these calculators empower you to make decisions that safeguard your financial health, preventing potential pitfalls.

B. Exploring Different Scenarios

1. Adjusting tenure for optimal results

EMI calculators offer flexibility in exploring different repayment scenarios. Adjusting the tenure allows you to observe the direct impact on monthly payments and overall interest outlay. This experimentation empowers you to make informed decisions that suit your financial goals.

2. Impact on interest payments

Understanding the correlation between tenure adjustments and interest payments is crucial. EMI calculators break down these complex relationships, offering clarity on how changes in tenure influence the overall interest paid. This knowledge becomes a strategic tool in optimizing your loan for cost-effectiveness.

X. Tips and Tricks for Using Loan Calculators Effectively

A. Updating Information Regularly

The dynamic nature of financial markets emphasizes the need for regularly updating information in loan calculators. Interest rates, fees, and other variables can change, affecting the accuracy of your calculations. Regular updates ensure that your financial projections remain reliable and reflective of current market conditions.

B. Considering Additional Costs

1. Hidden fees and charges

Loan calculators often focus on the principal amount, interest rate, and tenure. However, additional costs such as processing fees and other charges can significantly impact the total cost of the loan. Including these in your calculations provides a more comprehensive understanding of the financial commitment.

2. Insurance premiums

Overlooking insurance premiums is a common pitfall in loan planning. EMI calculators, when used effectively, incorporate insurance costs into the overall picture. This holistic approach ensures that your financial planning considers all relevant expenses, preventing surprises down the road.

XI. Innovations in Loan Calculators

A. Integration with Mobile Apps

The convenience of mobile apps extends to financial planning, with loan calculators becoming readily available on handheld devices. The integration of calculators into mobile apps simplifies the accessibility of these tools, allowing users to perform quick calculations on the go. This evolution in accessibility aligns with the fast-paced nature of modern life.

B. AI-powered Loan Calculators

The integration of artificial intelligence (AI) introduces a new era in loan calculations. AI-powered calculators leverage advanced algorithms to provide more accurate predictions, considering a broader range of variables. This innovation not only enhances accuracy but also adapts to individual financial behaviors, offering personalized insights for users.

C. Future Trends

Looking ahead, the future of loan calculators involves continuous technological advancements. From enhanced AI capabilities to seamless integration with personal finance management apps, these tools are poised to become even more intuitive and user-friendly. The future holds a promise of heightened efficiency and precision in financial planning.

XII. Addressing Privacy and Security Concerns

A. Safeguarding Personal Information

As technology evolves, so do concerns about data security. When using online loan calculators, ensuring the safeguarding of personal information is paramount. Choosing tools from reputable sources with robust security measures protects users from potential data breaches or misuse.

B. Choosing Reputable Online Calculators

Not all online calculators are created equal. Opting for calculators from trusted financial institutions or reputable websites adds an additional layer of security. Reviews, endorsements, and user testimonials can guide users in selecting calculators that prioritize the privacy and security of their financial data.

XIII. Case Studies: Success Stories with Loan Calculators

A. Real People, Real Savings

Embarking on financial journeys, individuals have successfully navigated challenges with the strategic use of loan calculators. These real-life stories serve as inspiration, showcasing the tangible impact of informed financial decision-making. From debt reduction to achieving financial goals, these case studies highlight the transformative power of financial tools.

B. Learning from Others’ Experiences

While success stories inspire, learning from others’ experiences involves understanding the pitfalls as well. Analyzing cases where financial plans faced challenges provides valuable insights. By assimilating these lessons, readers can enhance their financial acumen, avoiding common mistakes and optimizing their own financial strategies.

XIV. Common Mistakes to Avoid When Using Loan Calculators

A. Incorrect Data Entry

The accuracy of loan calculations hinges on the precision of data entry. Common mistakes, such as inputting incorrect principal amounts or interest rates, can lead to skewed results. Users must exercise diligence in ensuring that the information entered into calculators is accurate and up-to-date.

B. Ignoring Additional Costs

1. Hidden fees and charges

Underestimating the impact of hidden fees and charges can disrupt financial plans. Focusing solely on the principal amount and interest rate while disregarding additional costs can lead to unexpected financial burdens. Users are encouraged to conduct thorough research and include all relevant expenses in their calculations.

2. Focusing Solely on Monthly Payments

While monthly payments are a crucial consideration, fixating solely on this aspect can be shortsighted. Borrowers must look beyond the immediate monthly commitments and assess the overall cost of the loan, including the total interest paid. A holistic approach to financial planning ensures a comprehensive understanding of the financial commitment.

XV. Frequently Asked Questions (FAQs)

A. What loan details do I need for accurate calculations?

Accurate calculations rely on the input of essential loan details. Users should gather information such as the principal amount, interest rate, and loan tenure for precise results. This comprehensive data ensures that the calculations align with the specific terms of the loan.

B. How often should I update the information in the calculator?

Regular updates are crucial for maintaining the accuracy of loan calculations. Changes in interest rates, fees, or other variables can impact the overall projections. Users are advised to revisit and update the information in loan calculators periodically to ensure that the results remain relevant and reliable.

C. Can loan calculators predict future interest rates?

While loan calculators provide valuable insights into current financial scenarios, predicting future interest rates involves inherent uncertainties. Users should approach loan calculators as tools for informed decision-making based on existing conditions rather than as crystal balls for forecasting future market trends.

XVI. Future Prospects of Loan Calculators

A. Technological Advancements

The future of loan calculators is poised for significant technological advancements. From improved algorithms to the integration of machine learning, these tools will evolve to provide even more accurate and personalized predictions. The intersection of technology and finance promises a landscape where users can make decisions with unprecedented precision.

B. Integration with Personal Finance Management

The convergence of loan calculators with personal finance management tools represents the next frontier. Seamless integration will allow users to not only calculate loan details but also incorporate these insights into their broader financial plans. This interconnected approach streamlines financial management, providing users with a holistic view of their financial health.

XVII. Conclusion

A. Recap of Key Points

In conclusion, this comprehensive guide has navigated the intricacies of loan calculators and EMI calculators. From understanding their basic functionalities to exploring real-life examples and future trends, readers have been equipped with the knowledge to make informed financial decisions.

B. Encouragement for Utilizing Loan Calculators

The encouragement is for readers to actively incorporate loan calculators into their financial planning arsenal. Whether you’re a prospective homebuyer, a car enthusiast, or someone with diverse financial needs, these tools are designed to empower you with clarity and foresight.

C. Final Thoughts on Financial Empowerment

Financial empowerment stems from informed decision-making. By embracing the functionalities of loan calculators and staying abreast of technological advancements, individuals can navigate the complex terrain of borrowing with confidence. As the financial landscape evolves, so too will the tools that empower us to make sound financial choices.