Welcome to the Mortgage Calculator guide, where we demystify the intricacies of home loan estimates and empower you to make informed decisions. Whether you’re a first-time homebuyer or a seasoned investor, understanding the nuances of mortgage calculations is crucial for a smooth real estate journey.

Mortgage Calculator

Embarking on your homeownership journey? The Mortgage Calculator is your trusty companion. This powerful tool empowers you to estimate your monthly payments, plan your budget, and explore different financing scenarios. Let’s delve into its functionalities and discover how it can simplify your path to homeownership.

Exploring the Mortgage Calculator Features

How Does the Mortgage Calculator Work?

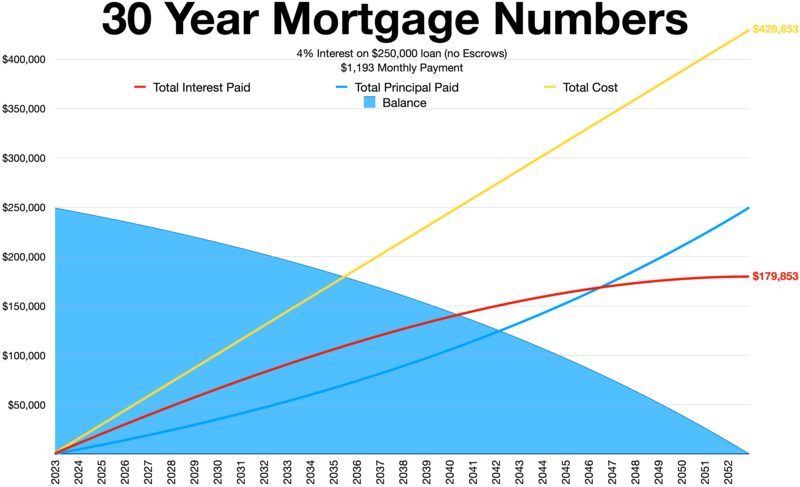

Understanding the inner workings of the Mortgage Calculator is pivotal. It takes into account your loan amount, interest rate, loan term, and down payment to provide a detailed breakdown of your monthly payments. This insight enables you to align your budget with your homeownership goals.

The Power of Mortgage Calculator in Budget Planning

When contemplating a home purchase, budgeting is key. The Calculator of mortgage allows you to tweak variables like interest rates and loan terms, helping you find a comfortable payment structure. Uncover the financial landscape and ensure your dream home aligns with your financial goals.

Navigating Mortgage Rates and Trends

Deciphering Mortgage Rates

Mortgage rates are the heartbeat of real estate financing. Learn how to interpret and leverage them to your advantage using the Mortgage Calculator. Stay ahead of market trends, ensuring you secure the best possible terms for your home loan.

The Impact of Economic Trends on Mortgage Rates

Economic shifts can influence mortgage rates. Discover how staying informed about economic trends can empower you in your homebuying journey. The Mortgage Calculator assists in foreseeing the impact of economic changes on your mortgage payments.

Crafting Your Mortgage Strategy

Choosing the Right Loan Type

Navigate the maze of loan types with ease. From fixed-rate mortgages to adjustable-rate mortgages, the Mortgage Calculator aids in comparing options. Tailor your strategy to your financial preferences and long-term goals.

Assessing Affordability with Mortgage Calculator

Before diving into the real estate market, assess your affordability using the Mortgage Calculator. Gain insights into your financial capacity, ensuring a seamless and stress-free homebuying experience.

Answering Your FAQs

Q: How accurate is the Mortgage Calculator? A: The Mortgage Calculator provides highly accurate estimates based on the information you input. However, it’s advisable to consult with a financial advisor for personalized advice.

Q: Can the Mortgage Calculator factor in property taxes and insurance? A: Absolutely. The Mortgage Calculator allows you to include property taxes and insurance costs, providing a comprehensive view of your monthly payments.

Q: Is a higher down payment always better? A: While a higher down payment can reduce your monthly payments, it’s essential to balance it with your overall financial goals. The Mortgage Calculator helps you find the sweet spot.

Q: Can I use the Mortgage Calculator for refinancing calculations? A: Certainly. The Mortgage Calculator is versatile, allowing you to explore various scenarios, including refinancing options.

Q: How often should I update my mortgage calculations? A: Regularly updating your calculations, especially when market conditions change, ensures that you stay informed and can adapt your strategy accordingly.

Q: Can the Mortgage Calculator help me understand the amortization schedule? A: Yes, the Mortgage Calculator breaks down your payments, showcasing how much goes toward principal and interest over time.

Conclusion

In conclusion, the Mortgage Calculator is your compass in the intricate world of home financing. Empower yourself with knowledge, leverage the tool’s capabilities, and embark on your real estate journey with confidence. From budgeting to navigating market trends, this guide has equipped you with the essential insights to make informed decisions.

Remember, the key to a successful homeownership journey lies in understanding your financial landscape. The Mortgage Calculator also called loan calculator is not just a tool; it’s your ally in achieving your homeownership dreams.