Introduction: Welcome to our dedicated space for home financing mortgage calculator, where we aim to simplify and enhance your financial planning with our advanced mortgage calculator. Navigating the intricate world of home loans can be a daunting task, but our user-friendly tool empowers you to make informed decisions. Whether you’re a first-time buyer or looking to refinance, our home financing mortgage calculator provides accurate insights, helping you crunch the numbers and strategize your path to homeownership with confidence. Explore the possibilities and take control of your financial future as you embark on this exciting journey towards owning your dream home.

Table of Contents

Unlocking Homeownership: Your Guide to Using a Mortgage Calculator

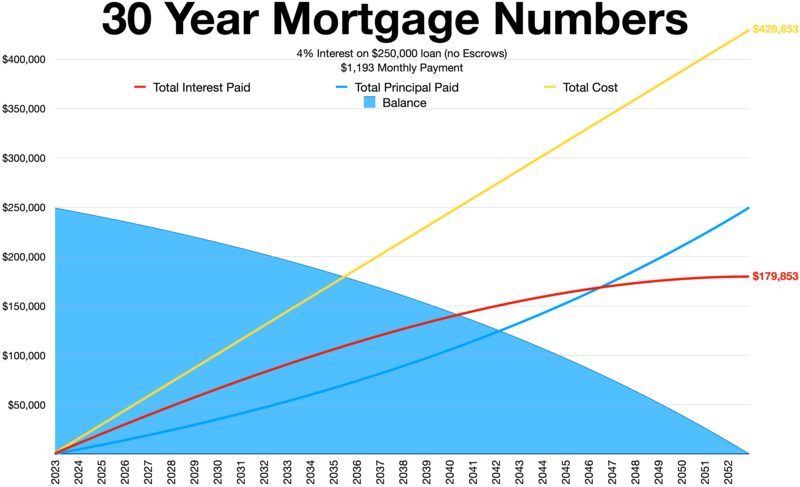

Understanding Mortgage Calculators: Before diving into the specifics, it’s crucial to grasp the fundamentals of mortgage calculators. These online tools are designed to estimate your potential monthly mortgage payments based on various factors such as loan amount, interest rate, and term length. By inputting these variables, you can gain insights into your financial obligations and plan accordingly.

Smart Financing Starts Here: Utilizing the Home Mortgage Calculator

Assessing Your Financial Situation: One of the first steps in the home buying process is evaluating your financial readiness. With a mortgage calculator, you can determine how much house you can afford by inputting your income, existing debts, and desired down payment. This helps you set realistic expectations and avoid overextending yourself financially.

Crunching Numbers for Your Dream Home: The Ultimate Mortgage Calculator Tool

Exploring Loan Options: Mortgage calculators are versatile tools that allow you to compare different loan scenarios. Whether you’re considering a fixed-rate or adjustable-rate mortgage, you can input various parameters to see how they affect your monthly payments. Additionally, you can experiment with different down payment amounts to find the optimal balance between upfront costs and long-term affordability.

Navigate Home Financing with Ease: A Deep Dive into Mortgage Calculators

Planning for Additional Expenses: Owning a home involves more than just mortgage payments. Property taxes, homeowners insurance, and maintenance costs are essential factors to consider when budgeting for homeownership. Fortunately, many mortgage calculators offer options to include these expenses in your calculations, providing a comprehensive view of your overall housing costs.

Empowering Your Financial Journey: Mastering the Home Financing Mortgage Calculator

Refining Your Strategy: As you fine-tune your home buying strategy, a mortgage calculator becomes an invaluable tool for scenario planning. Whether you’re considering paying points to lower your interest rate or evaluating the impact of making extra payments, you can use the calculator to weigh the pros and cons of different approaches. This enables you to make informed decisions that align with your financial goals.

Strategic Home Loan Planning: How to Maximize the Mortgage Calculator Advantage

Conclusion: Ultimately, the key to successful homeownership lies in thorough preparation and informed decision-making. By harnessing the power of a mortgage calculator, you can navigate the complexities of home financing with confidence and clarity. Remember, the path to owning your dream home may have its challenges, but with the right tools and knowledge at your disposal, you can overcome obstacles and secure a bright future for you and your family.

From Figures to Freedom: Harnessing the Power of the Mortgage Calculator

Additional Resources: For further assistance on your home buying journey, consider consulting with a reputable mortgage advisor or financial planner. They can provide personalized guidance tailored to your unique circumstances and help you make sound financial choices. Additionally, many reputable financial websites offer comprehensive guides and resources on home financing, mortgage calculators, and related topics. Take advantage of these resources to expand your knowledge and make informed decisions every step of the way.

Your Path to Property Ownership: Unleashing the Potential of Mortgage Calculators FAQs:

- How accurate are mortgage calculators?

Mortgage calculators provide estimates based on the information you input. While they can give you a good idea of your potential monthly payments, it’s essential to consult with a mortgage lender for a more accurate assessment. - Can I use a mortgage calculator for refinancing?

Yes, mortgage calculators are useful for refinancing as well. You can input your current loan details along with new loan terms to see how refinancing may impact your monthly payments and overall savings. - Are there any fees associated with using a mortgage calculator?

Most mortgage calculators are free to use and accessible online. However, some lenders may offer more advanced calculators with additional features for a fee. - Can a mortgage calculator help me decide between renting and buying?

Yes, mortgage calculators can help you compare the costs of renting versus buying a home. By inputting your monthly rent and potential mortgage payments, along with other expenses, you can determine which option may be more financially advantageous in the long run.

Financial Clarity in Homebuying: A Step-by-Step Guide with Mortgage Calculators

In conclusion, leveraging a mortgage calculator is essential for anyone embarking on the journey to homeownership. By understanding how to use this tool effectively, you can gain clarity on your financial situation, explore loan options, and refine your home buying strategy. Whether you’re a first-time buyer or a seasoned homeowner, let the mortgage calculator be your guide towards achieving the dream of owning a home. So, embrace the journey, stay informed, and trust in your ability to make wise choices that will shape your future for years to come. Happy house hunting!