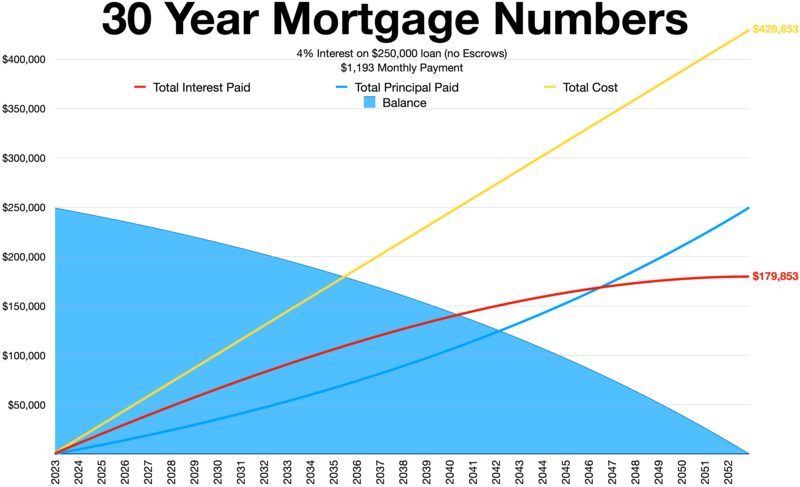

Looking to unlock your dreams of homeownership? Whether you’re a first-time buyer or looking to upgrade, securing the perfect home loan is essential. In this guide, we’ll show you how to calculate and secure the ideal home loan with the Bank of Wells Fargo. At Wells Fargo, we understand that your dream home is more than just bricks and mortar. It’s a place where memories are made and cherished. That’s why we are dedicated to helping you find the right loan option that suits your unique needs.

Calculating your home loan is the first step toward turning your dream into a reality. Our user-friendly online tools and resources make it easy for you to determine your budget, estimate your monthly payments, and evaluate different loan options. With a range of loan programs available, from fixed-rate mortgages to adjustable-rate mortgages, we have the flexibility to meet your requirements.

Securing a home loan shouldn’t be stressful, which is why our team of experienced mortgage specialists is here to guide you through the process. With our competitive interest rates, transparent fees, and personalized service, you can feel confident knowing that you are in good hands. Unlock your dreams today and start your homeownership journey with Wells Fargo Bank.

Unlock Your Dreams: How to Calculate and Secure the Perfect Home Loan with Wells Fargo Bank

Understanding Home Loans & Home Loan Calculator

The journey towards homeownership begins with a fundamental understanding of home loans. This section delves into the basics of home loans, highlighting the essential aspects borrowers need to grasp before venturing into the housing market.

Benefits of Securing a Home Loan with Wells Fargo Bank

Wells Fargo Bank emerges as a prominent player in the mortgage market, offering numerous advantages to those seeking homeownership. Explore the distinct benefits that come with securing a home loan through Wells Fargo Bank, including competitive interest rates, diverse loan options, and a commitment to customer satisfaction.

Types of Home Loans Offered by Wells Fargo Bank

Wells Fargo Bank caters to the diverse needs of potential homeowners by providing a range of home loan products. This section outlines the various types of loans available, such as fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and jumbo loans, enabling borrowers to make informed choices based on their unique financial situations.

Factors to Consider When Calculating Your Home Loan

Calculating a home loan involves a thorough consideration of multiple factors. This section guides readers through the crucial aspects to ponder when determining loan amounts, interest rates, and repayment terms. From credit scores to debt-to-income ratios, discover the elements that play a pivotal role in the home loan calculation process.

Calculate a Home Loan

How to Qualify for a Home Loan with the Bank of Wells Fargo

Securing a home loan with Wells Fargo Bank necessitates meeting specific eligibility criteria. This section outlines the steps potential borrowers can take to enhance their qualification chances, covering areas such as creditworthiness, income stability, and the documentation required to navigate the application process successfully.

Steps to Secure a Home Loan with Bank of Wells Fargo

The process of securing a home loan involves a series of strategic steps. From prequalification to closing the loan, this section provides a comprehensive overview of the steps Bank of Wells Fargo has in place to streamline the application process, ensuring a smooth and efficient experience for borrowers.

Tips for Managing Your Home Loan Payments

Successfully securing a home loan is just the beginning; effective management of payments is crucial for sustained financial stability. This section offers practical tips for borrowers on managing their home loan payments responsibly. From setting up automatic payments to exploring additional payment options, discover strategies to navigate the repayment phase seamlessly.

Tools and Resources Offered by Wells Fargo Bank for Home Loan Borrowers

Wells Fargo Bank extends its commitment to customer satisfaction by providing an array of tools and resources for home loan borrowers. This section explores the online calculators, educational materials, home loan calculators, and personalized support offered by Wells Fargo Bank, empowering borrowers with the knowledge and assistance needed for a successful homeownership journey.

Common Mistakes to Avoid When Applying for a Home Loan

In the excitement of pursuing homeownership, it’s easy to overlook critical details. This section highlights common mistakes that borrowers should avoid when applying for a home loan. By understanding and sidestepping these pitfalls, prospective homebuyers can navigate the application process with greater success.

Conclusion: Achieving Your Dream of Homeownership with Wells Fargo Bank

As the article concludes, it reinforces the significance of securing a home loan with a reputable institution like Wells Fargo Bank. Emphasizing the importance of understanding the nuances of home loans, utilizing available resources, and avoiding common pitfalls, this section serves as a final guide for readers on the journey toward realizing their dream of homeownership with Bank of Wells Fargo.