Introduction

In the intricate world of auto financing, precision is key. The Auto Loan Calculator emerges as your trusty companion, offering clarity in the face of financial complexity. Let’s embark on a journey through the ins and outs of this invaluable tool, helping you make astute decisions while steering towards your dream car.

Table of Contents

Auto Loan Calculator: A Roadmap to Financial Precision

Understanding the Basics

Embarking on your auto financing journey requires a solid grasp of the fundamentals. The Auto Loan Calculator provides an immediate overview of your potential monthly payments, allowing you to tailor your financial commitment to your comfort zone.

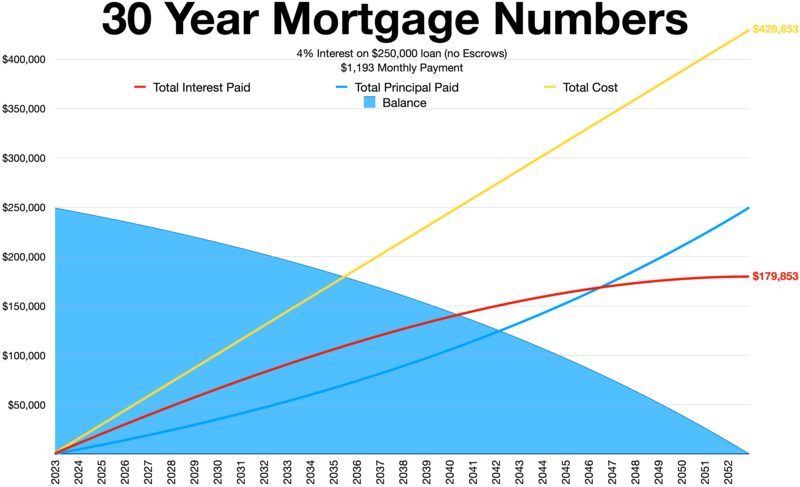

The Significance of Interest Rates

Interest rates, the silent architects of your financial landscape, play a pivotal role in your auto loan journey. Our calculator not only crunches the numbers but empowers you to negotiate favorable terms, ensuring your budget remains intact.

Loan Term Optimization

Unveiling the secrets of loan terms, our calculator aids in optimizing your repayment plan. Navigate through various terms, striking the perfect balance between monthly affordability and overall interest payments.

Down Payment Dynamics

Discover the magic of down payments and witness firsthand their influence on your monthly commitments. Our calculator lets you experiment with different figures, empowering you to find the sweet spot that aligns with your budgetary constraints.

Empowering Your Decision-Making

Budgeting Wisdom

Armed with the insights from our Auto Loan Calculator, embark on a journey of budgeting wisdom. Align your aspirations with financial reality, ensuring your dream car doesn’t become a financial burden.

Tips for Loan Approval

Securing loan approval becomes a seamless process when armed with knowledge. Learn the insider tips that transform the application process into a swift and successful endeavor.

The Impact of Credit Scores

Delve into the intricacies of credit scores and witness their profound impact on your loan terms. Our guide not only demystifies credit scoring but provides actionable steps to enhance your financial profile.

FAQs: Unveiling the Enigma

How does the Car Loan Interest Rate Calculator work?

Our calculator employs a sophisticated algorithm, factoring in loan amount, interest rate, and term to deliver accurate monthly payment estimates. Simply input your values, and let financial clarity unfold.

Is a larger down payment always beneficial?

While a larger down payment often reduces monthly payments, it’s essential to strike a balance. Our calculator helps you find the optimum down payment, aligning with your financial goals.

Can the Auto Loan Calculator assist with refinancing decisions?

Absolutely! Whether evaluating current loan terms or considering refinancing options, our calculator provides real-time insights, guiding you toward a financially sound decision.

What role does my credit score play in loan approval?

Credit scores significantly influence loan approval and interest rates. Explore our guide to understand the intricacies and discover strategies to enhance your creditworthiness.

How often should I use the Auto Loan Calculator?

Regularly revisiting the calculator ensures your financial plan remains aligned with your goals. Use it when considering a new vehicle, changes in financial circumstances, or periodic financial check-ups.

Can the Auto Loan Calculator predict approval odds?

While the calculator offers valuable insights, it doesn’t guarantee approval. Approval depends on various factors, including income, existing debt, and the lender’s criteria.

Conclusion

In the realm of auto financing, knowledge is power. Armed with our comprehensive guide and the versatile Auto Loan Calculator, you’re well-equipped to navigate the complexities of auto loans. Make informed decisions, embark on your vehicle journey with confidence, and enjoy the ride towards financial freedom.