Introduction

Welcome to the world of financial empowerment, where the Loan Calculator and Loan EMI Calculator stand as beacons of clarity in the complex landscape of loans and repayments. In this comprehensive guide, we’ll delve into the intricacies of these tools, ensuring you not only understand how they work but also empower you to make sound financial decisions.

Table of Contents

Exploring the Loan Calculator Landscape

Financial Navigators: Loan Calculator and Loan EMI Calculator Embark on a journey of financial discovery with the Financial Calculator and Loan EMI Calculator. These indispensable tools act as your navigators, helping you sail through the complexities of loans. Whether you’re planning a mortgage, personal loan, or car loan, the Loan Calculator and Loan EMI Calculator are your trustworthy companions.

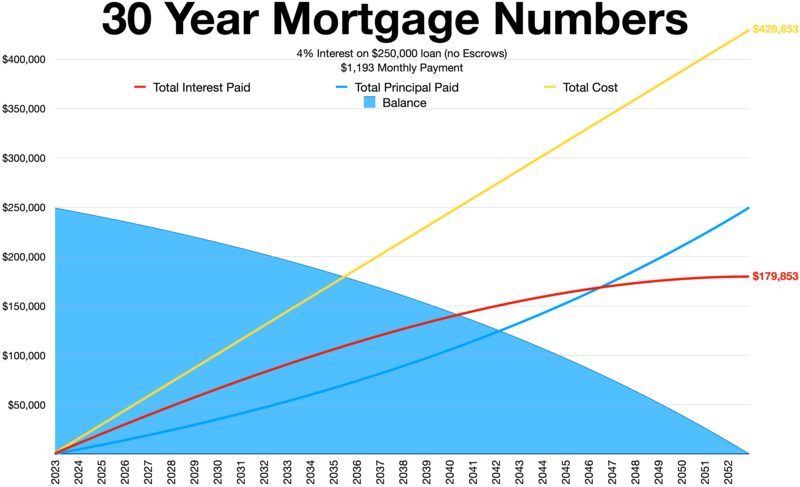

Understanding the Basics Before we delve into the nuances, let’s grasp the basics. A Loan Calculator helps you estimate your monthly payments, total interest, and loan term based on the principal amount and interest rate. On the other hand, the Loan EMI Calculator specifically focuses on equated monthly installments, providing insights into your repayment structure. Both are dynamic tools that adapt to your financial inputs, providing instant insights.

Why Use These Calculators? Uncover the advantages of using Loan Calculators and Loan EMI Calculators. From budgeting effectively to comparing loan options and understanding installment structures, these tools empower you. No more financial uncertainties – the Loan Calculator and Loan EMI Calculator put you in control, allowing you to make informed decisions.

Demystifying Loan Types

Personal Loans Unveiled Navigate the realm of personal loans with confidence. Discover how the Loan Calculator and Loan EMI Calculator tailor results based on the loan type, interest rate, and repayment term. Personalize your financial journey and achieve your goals with ease.

Mortgage Magic For aspiring homeowners, the Mortgage Loan Calculator is a game-changer. Dive into the world of mortgage planning, understanding how interest rates, down payments, and loan terms interact. The Loan Calculator ensures you find a mortgage that aligns with your dreams, while the Loan EMI Calculator sheds light on your monthly repayment commitments.

Loan Calculator and Loan EMI Calculator: Your Financial Allies

Monthly Budgeting Learn how the Loan Calculator and Loan EMI Calculator become your allies in monthly budgeting. With precise calculations, they aid in crafting a budget that accommodates your loan repayments without compromising your lifestyle.

Crucial Factors Impacting Calculations Explore the key factors influencing Loan Calculator and Loan EMI Calculator results. From interest rates to loan terms, understanding these nuances empowers you to tweak variables and witness real-time changes in your financial projections.

Unlocking Loan Calculator and Loan EMI Calculator Secrets

Pro Tips for Effective Calculations Delve into expert tips for optimizing your Loan Calculator and Loan EMI Calculator experience. Discover hacks to save on interest, shorten your loan term, and navigate financial twists with ease. Empower yourself to make strategic financial decisions.

Calculator Pitfalls to Avoid While powerful tools, the Loan Calculator and Loan EMI Calculator have their limitations. Uncover potential pitfalls and learn how to navigate them. Our insights ensure you use the tools effectively without falling into common traps.

Loan Calculator and Loan EMI Calculator in Action

Real-Life Scenarios: Case Studies Embark on a journey through real-life case studies showcasing the Loan Calculator and Loan EMI Calculator in action. Witness how individuals achieved financial milestones by harnessing the tools’ potential. Be inspired to script your financial success story.

Success Stories: Navigating Loans Successfully Read success stories from individuals who utilized the Loan Calculator and Loan EMI Calculator to overcome financial challenges. These tales of triumph highlight the tools’ versatility and their role in transforming financial dreams into reality.

Loan Calculator FAQs

Accuracy of Results Loan Calculator and Loan EMI Calculator results are highly accurate, provided the input information is precise. Minor discrepancies may arise due to external factors, but overall, they are reliable tools for financial planning.

Using the Tools for Different Loans Absolutely! The Loan Calculator and Loan EMI Calculator are versatile and can be employed for various loans, including personal loans, mortgages, and car loans. Their adaptability makes them go-to tools for diverse financial needs.

Tool Complexity Not at all. Loan Calculators are designed to be user-friendly. With straightforward inputs and instant results, even those new to financial planning can navigate the tools effortlessly.

Saving Money with the Calculators Yes, by providing insights into interest payments, optimal loan terms, and installment structures, the Loan Calculator and Loan EMI Calculator empower you to make choices that save money over the long term.

Unexpected Results If the results are unexpected, double-check your input information. Small errors can lead to significant differences in outcomes. Ensure all details are accurate for precise results.

Reliability for Long-Term Planning. The Loan Calculator and Loan EMI Calculator’s ability to project long-term outcomes makes them valuable tools for comprehensive financial planning. They adapt to changes in interest rates and repayment terms, ensuring accuracy over time.

Conclusion

In the realm of financial planning, the Loan Calculator and Loan EMI Calculator emerge as beacons of empowerment. Armed with accurate projections, real-life insights, and expert tips, you’re now equipped to navigate the intricate world of loans. Harness the power of the Loan Calculator and Loan EMI Calculator and embark on your journey to financial success.